District 65 and ETHS Request 5% Increase in Tax Levies

And a brief discussion of upcoming political deadlines

Update: Some of my information regarding tax years and annual calculations may be incorrect. I’m reviewing this today - IL tax law is confusing!

First, some notes on the upcoming elections!

Candidate Deadline is Monday

Tomorrow (November 18th) is the filing deadline for candidates to submit their petitions to run for District 65 Board seats (link of all candidates). Currently there are 10 candidates who have filed for the 4 District 65 Board seats.

I’ve reached out to as many folks on the list that I can find - but I haven’t been able to contact Heather Vezner or Lionel Gentle. If you know them, send them to me: tom@foiagras.com. I’d like all the candidates to have the option to pitch themselves here so I’m doing my best at outreach.

On the ETHS side, there are currently 3 candidates for the 4 open seats

Please hold off on commenting on any candidates until I can give them a chance to introduce themselves and their platform.

Referendum Deadline is January 13th

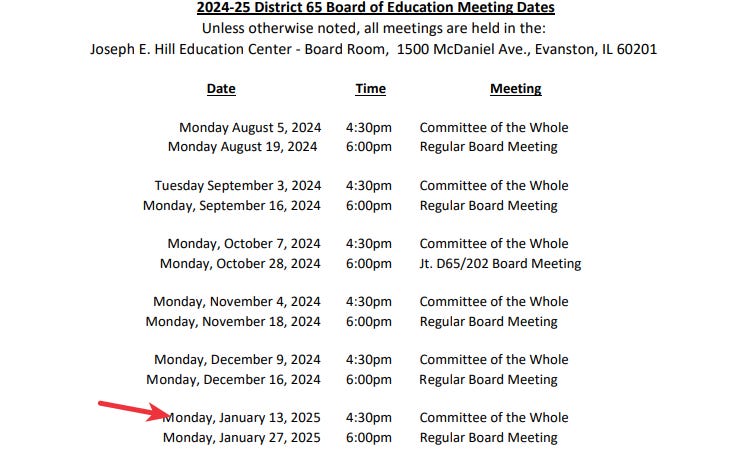

The Cook County site shows 2 dates for referenda to be added to the April 1, 2025 ballot.

Monday, December 30: Last day for filing petitions for referenda for the submission of questions of public policy with the local election official

Monday, January 13: Last day for local governing boards to adopt a resolution or ordinance to allow a binding public question to appear on the ballot

There are 4 District 65 meetings between now and January 13th, including a meeting on January 13th.

Given that the District 65 Administration won’t be presenting recommendations for the deficit reduction plans until mid-January, the Board will likely have one or no opportunity to consider a referendum on the April 1, 2024 ballot. After that, the next chance won’t be until March 17, 2026 (Gubernatorial Primary) or November 3, 2026 (2026 midterms). If the Board had some optionality to consider a revenue, they’re limiting themselves to only one meeting by waiting until January to discuss the deficit reduction plan.

But they can still ask for annual increases in tax levies.

District 65 Requests 4.99% Tax Increase

The District 65 Board will be reviewing a 4.99% increase proposal in tomorrow’s agenda. ETHS recently asked for a 6.2% property tax increase. According to Illinois law, the maximum the public body can obtain is 5% or CPI, whichever is lower.

Illinois tax calculations are very arcane and even the Cook County Treasurer’s own explanation document seems to indicate they also hate it and view it as racist.1

Either way, it seems to work like this:2

The County Assessor goes through and determines the assessed values of all properties in an area. This is called the Equalized Assessed Value (EAV). Assessments are on a 3 year rotating cycle. They sometimes use the Zillow Zestimate!

Cook County, for whatever reason, has a fiscal year that starts on December 1. So tax year 2024 actually starts in two weeks. The 1st payment is due in the following August and then the 2nd payment is due the following December.

In November of the year, the public bodies request some % increase in tax levies from Cook County. They publish a Truth in Taxation notice. Here is D65’s and ETHS’s for this year.

They always ask for more than the CPI (inflation rate) because they don’t actually know how much money they are going to get. If they only asked for CPI and the EAVs drop for whatever reason, they could get less than CPI.

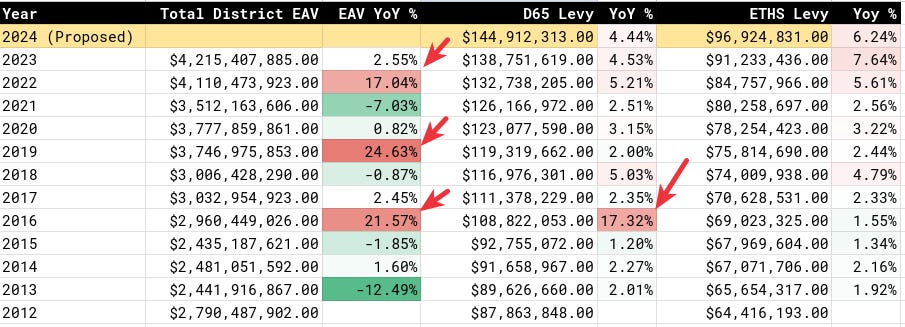

I tried my best to construct the tax levy history for D65 and D202 - it’s easy to find the requests for money but it’s hard to find the actual revenue they bring in because none of the fiscal years line up. I constructed this from documents on this County website.

Couple things to note:

You can see the three year cycle where property taxes jumped (2016, 2019, 2022). This is the rotating assessment cycle done by the Cook County Assessor Fritz Kaegi’s office.

You can see the District 65 2017 referendum, which was actually in tax year 2016. 🤦 It gave District 65 a big bump in levies they could assess going forward.3

You can see some years where they asked for a 5% increase and received less than that because the CPI was so low, like tax years 2019-2021.

ETHS’ levy recently has gone over 5% for a couple years in a row. I think this is more of a calculation/numbers/timing issue than a mistake.

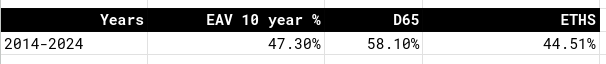

Over a 10 year period, District 65’s local tax levy has increased 58%. ETHS’s tax levy has only 44%. During this time, the total EAVs have increased 47%. According to the Federal Reserve, inflation during this time has been 33.34%. So in real dollars, we’re falling behind.

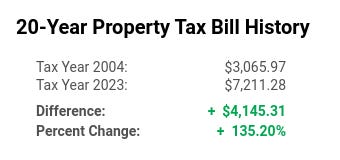

This is, of course, reflected in individual tax bills. I went and dug up the tax records for a 2 bed 1 bath 1,500 square foot condo in Southeast Evanston (near Hinman and Keeney). For this condo, over a 20 year period, the taxes have increased a whopping 135.2%, while inflation during the period was only 67%. The image below is courtesy of the County Treasurer’s website.

Throw on another couple hundred bucks for tax year 2024.

It’s good to know that the Treasurer is willing to call out things like Scavenger Sales as predatory and then not actually do anything about it. See page 25 of that PDF. It’s very weird to read the document, explaining how Scavenger Sales work and how to participate in them .. followed by sections explaining how the Treasurer is failing at their mission to do Scavenger Sales.

If I made a mistake here, please correct me. I did my best to figure this out but I’m not a rocket scientist.

I think there is a misunderstanding that it was like a one time deposit of cash. It was actually just a bump in tax levy beyond the standard minimum of 5% or CPI.

Congratulations, Tom! You are the reason we will be able to get rid of the current D65 Board. No incumbents are running. Maybe just maybe things can turn around.

"tax year 2024 actually starts in two weeks." You meant 2025.