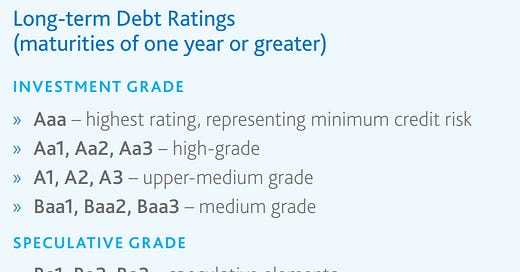

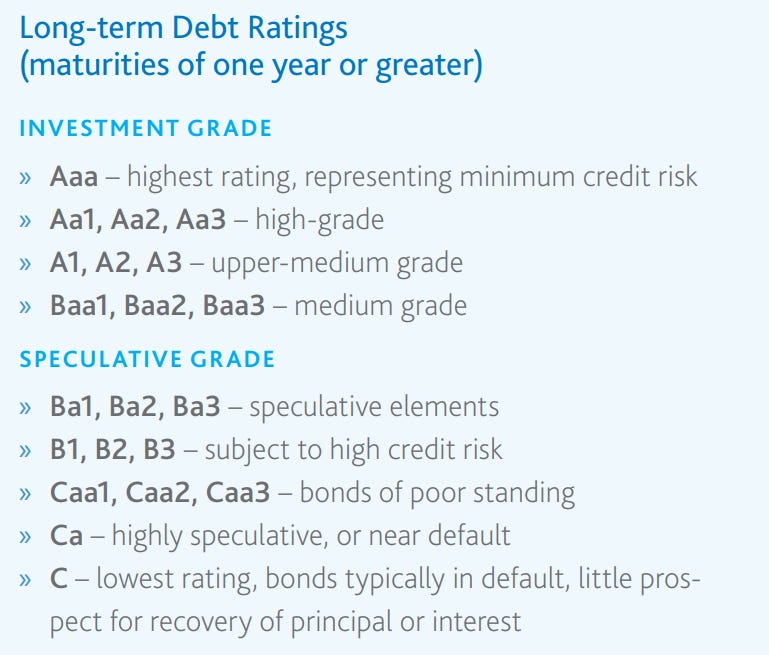

Moody's Investors Service is credit rating agency which evaluates the creditworthiness of companies, governments, and financial instruments. They issue a score for various types of debt. You can view their ranking system below or on this website.

Moody’s downgraded District 65 one notch from an Aa2 to an Aa3 rating. You can read their press release. Moody’s cites annual losses and declining reserves as a primary reason for the decline;

Moody's Ratings (Moody's) has downgraded Cook County Community Consolidated School District 65 (Evanston/Skokie), IL's issuer rating and outstanding general obligation limited tax (GOLT) and lease certificate ratings to Aa3 from Aa2. As of September 2023, the district had roughly $90 million in debt outstanding.

The ratings were downgraded because of operational imbalance and declining reserves. The imbalance was caused by rising costs and a decline in federal stimulus and personal property replacement tax revenues, resulting in an operating deficit of about $16.2 million in fiscal 2023 (year-end June 30). Preliminary results reveal a $9.9 million deficit in fiscal 2024 and the district is budgeting for a $12.2 million deficit in fiscal 2025. The district is currently evaluating expenditure reductions for fiscal 2026.

Governance is a driver of this rating action given the persistent budget imbalance.

According to the Moodys Rating System, District 65 debt is still considered high grade. However, a downgrade may result in higher interest rates, including the lease certificate for the Foster School Project. It’s not entirely clear to me yet what the implications will be, but you can read the lease certificate or view details on the debt, including the Moody’s rating. If you know more about this, please email me or leave a comment.

I’ve written extensively about the $40 million lease certificate and you can read my most recent story on the subject: Is this Securities Fraud? The lease certificate itself contains a misrepresentation regarding the bus savings, claiming that the debt will be funded by $3.25 million in bus savings, when the actual savings number is closer to $750,000.

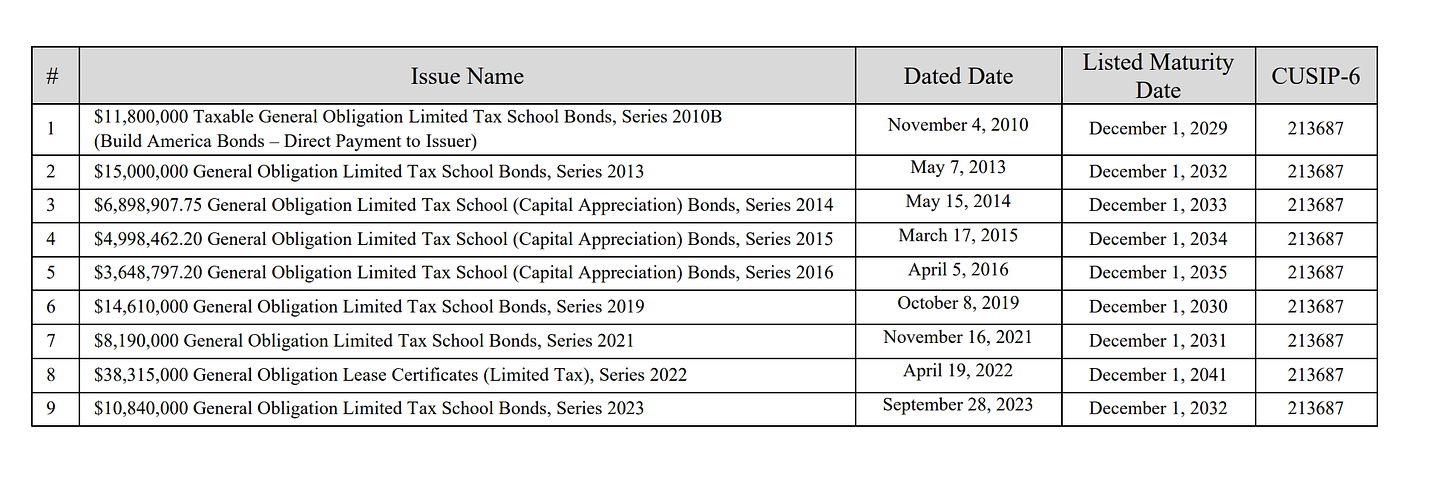

According to the District’s annual statement of affairs on 6/30/2023, they had $99,073,290 in long-term debt. ETHS by comparison, on that same date had $28,664,486 in debt.1

The full list of debt issues is available at this link or in the image below.

The press release also notes the ratings of other local communities;

Cook County Community Consolidated School District 65 (Evanston/Skokie) is located 12 miles north of downtown Chicago (Baa3 positive) in Cook County (A1 positive) and serves the City of Evanston (Aa2) and a small portion of the Village of Skokie (Aa2). The district operates 18 school facilities providing pre-K through 8th grade education to about 6,200 students.

District 65 has fallen behind the City of Evanston and Skokie but according to Moody’s remains more creditworthy than Cook County of the City of Chicago.

It’s not clear why the ASA statement has a $99 million in debt and the Moody’s documents say $90 million. It might be a timing thing or how things are classified.

Oof, that last paragraph in the quote from Moodys says it all ...

Back when the lease certificates were being issued and the administration was carrying on about the District's credit rating, I asked Obafemi how it could have a great credit rating given that they were talking about a structural deficit even then. He said it was based primarily on how efficient the District was in realizing tax revenue and since the District was close to 100%, it would take a lot to see a downgrade.

Guess that bridge has been crossed ....

Congrats, Sergio, Biz, Mya, Soo, Joey, Donna, and Omar!