Tonight: District 65 to Vote on $23 million of Construction Costs for Foster School

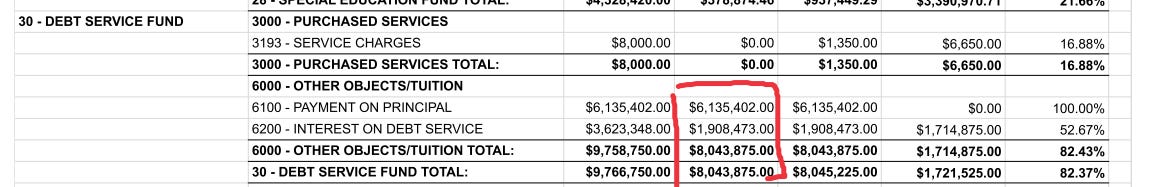

And District 65 makes their first principal payment on the lease certificate.

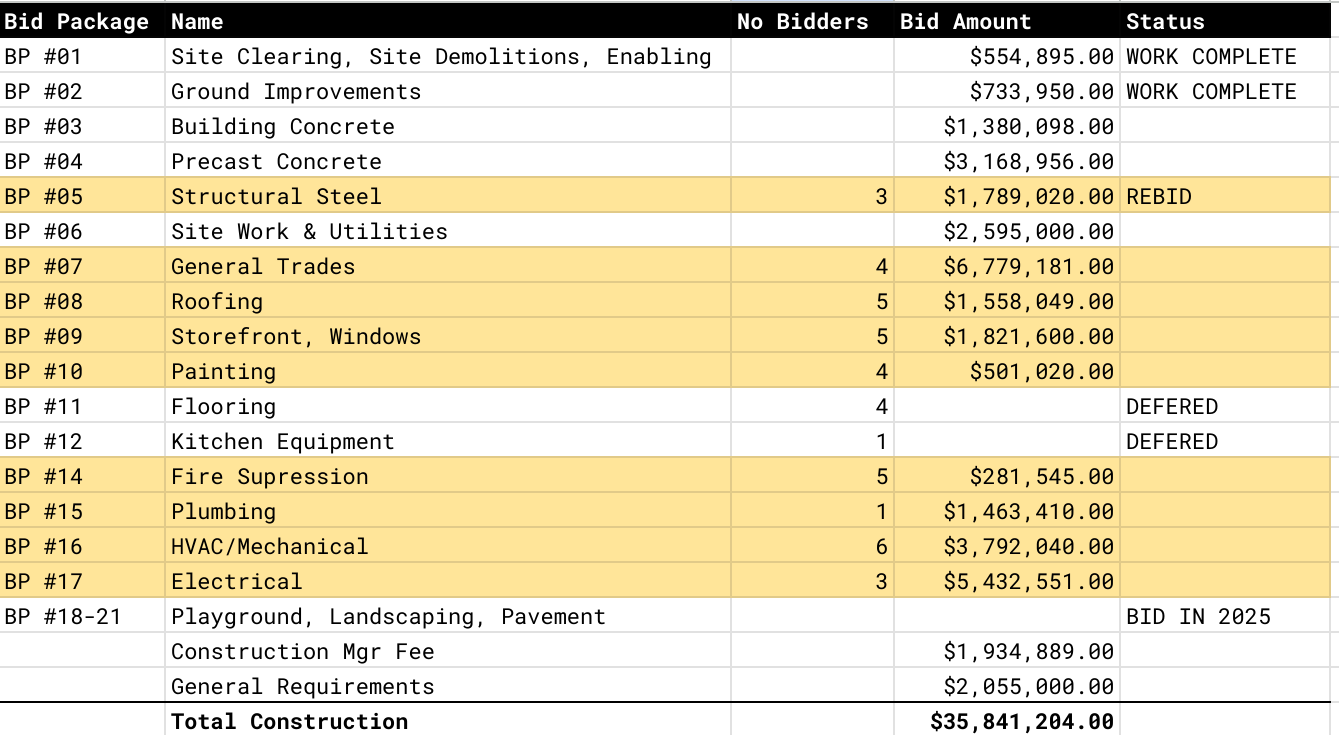

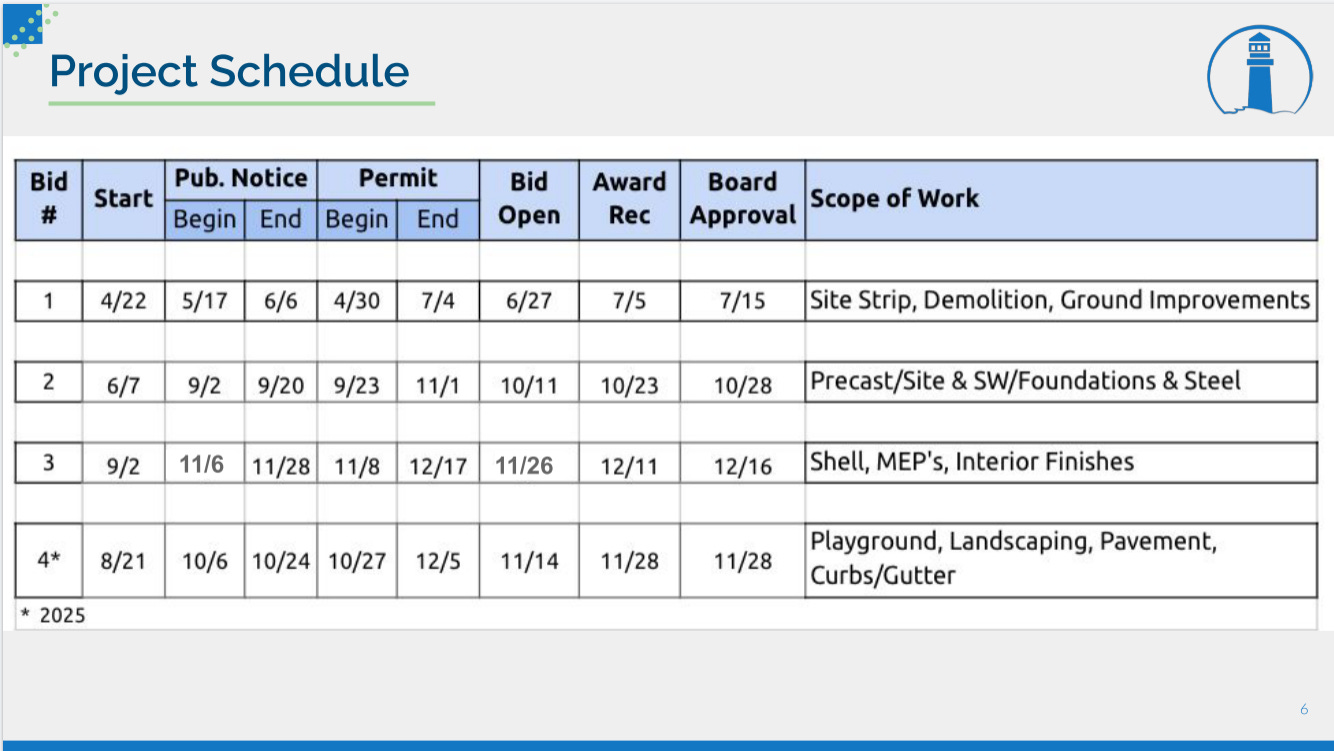

Tonight, the District 65 Board will be voting on $23 million worth of costs tonight for the Foster School. You can view the document from Cordogan-Clark here. This bid package consists of the bulk of construction costs from electrical, to plumbing, to HVAC for the Foster School. I’ve highlighted the packages in yellow below.

In addition, the Board rebid package #5 for Structural Steel after getting a bid in October for $2,453,000. The new bids came in at $1,789,020, saving $663,980.00. Credit where credit is due - they saved some money. If this was on the advice of the owner’s representative they hired (for $304,335) - then they easily earned their charge.

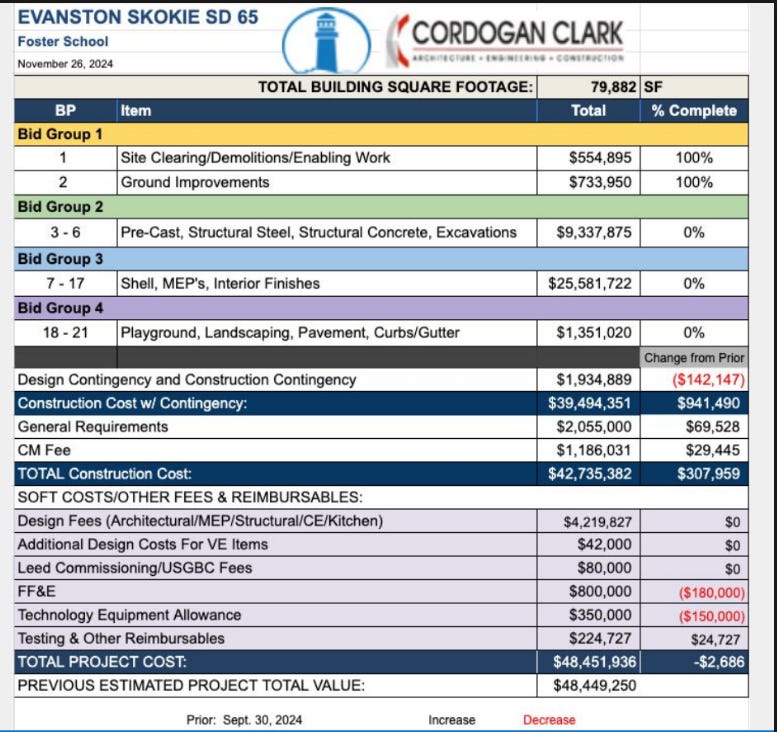

Last month, Cordogan-Clark shared an update of total costs on the project, showing total construction costs to come in around $42 million and all-in costs around $48 million - you can read their documents here or see the table below. This includes about $2 million in contingency budget. This seems about right to me given the bid package they will be voting on today.

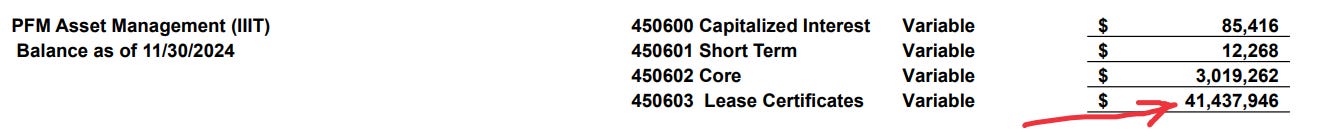

These costs will be paid by funds from the lease certificate - which right now has about $41.4 million in the account. It’s not yet clear to me how the non-construction costs will be funded, including furniture in the building.

This is penultimate bid package, with the final one for playground, landscaping, and other equipment to come in later in 2025.

I don’t see any way they turn back after this - I mean, I guess you could but that would result in a pit or half built building or something worse. If you are a proponent of the Foster School, this is the only vote that actually matters to the completion of the project. Everything up until now has just been fluff - this is the real bulk of the construction.

This vote should’ve happened in early 2022 and been tied to a passing referendum, but here we are…

$3.25 Million Annual Lease Cert Payments 💸

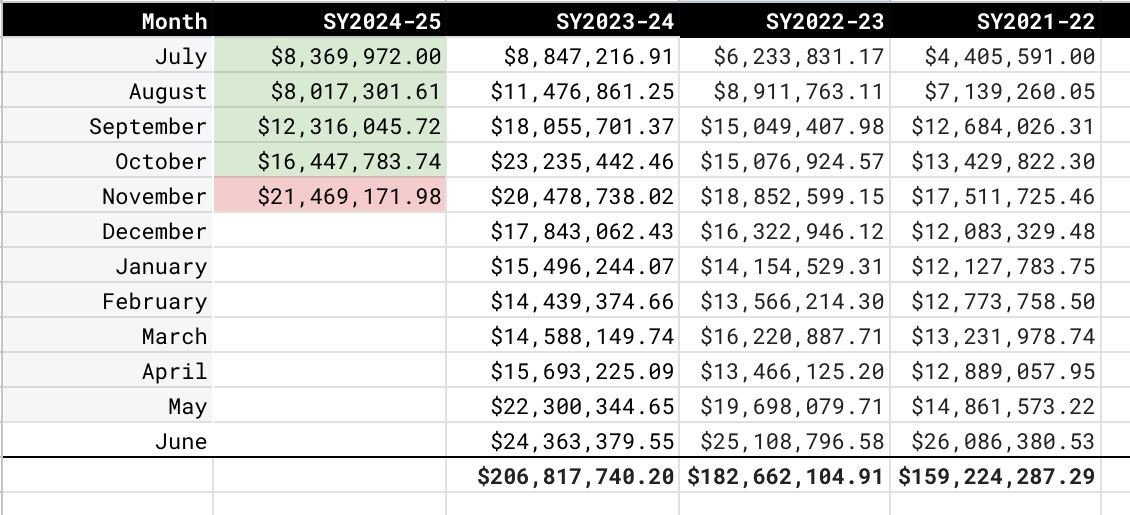

Speaking of the budget going forward, I started maintaining a spreadsheet that is similar to the one we used when I worked in corporate finance at GrubHub. Due to seasonality, the business’ revenue and expenses were not evenly distributed. We would look at prior year’s numbers and use that to project what current year would be based on when revenue and expenses came in. We used this for our public reporting - in the IPO and for public quarterly filings for investors.

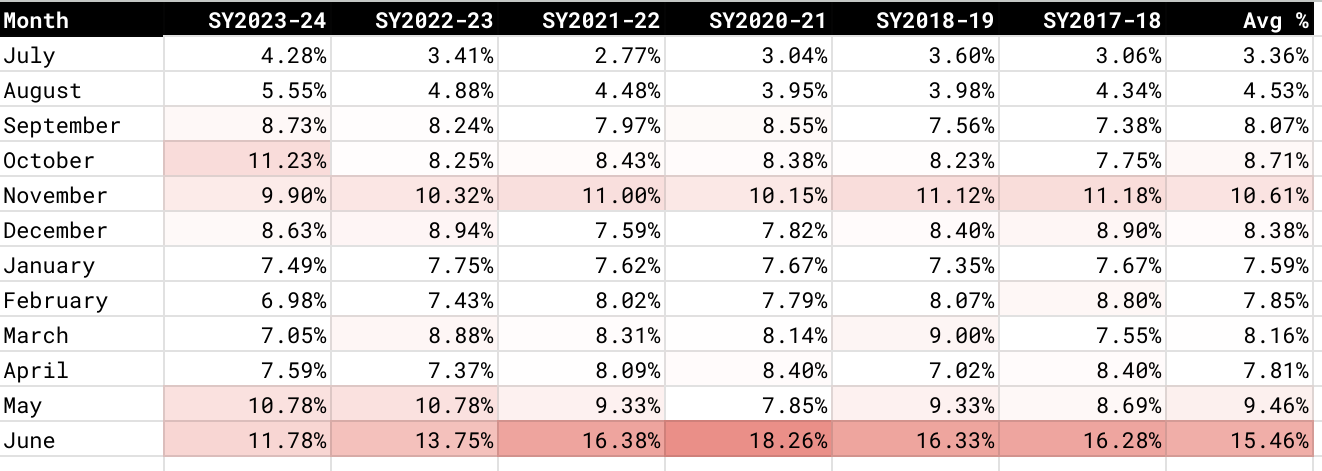

For District 65 it looks like the below table (excluding the COVID year). You read this: on average, in July of the fiscal year, 3.36% of the annual expenses are paid. Meanwhile, in the last month of the year, June, 15% of annual expenses come in. Costs are very uneven because of things like payments to vendors related to students being in school and lump sum payments to teachers for the Summer (in June).

District 65 now has timely financial reporting, so we can look at the numbers that have come in for this year. Timely financial reporting is something I haven’t seen since starting the blog - during the Horton era, they were regularly 2-3 months behind on financial board reporting, including a few months during COVID they never even shared the numbers.

Anyway, the expenses for this year are improving over last year’s disastrous deficit.

Almost every month has come in with expenses lower than the previous year. In October for instance, District 65 spent about $7 million less than in 2023-24. This is with the exception of November, which came in about a million dollars higher than in prior year. Why?

The payments on the Foster School lease certificate, are split into two payments and made in May and November of every year. This is the first year of the principal payment.

There is other debt included in the total $8 million dollar number paid, but if you look at last November, District 65 paid $4.25m in payment on principal debt service and this year $6.13m - a difference of about $1.87m - or about half the lease certificate annual payment. You could chop that out of the November number for this year if you wanted to to compare apples to apples operational expenses - but I think you should leave it in - it’s a real cost to consider for the next 17 years.

With that said, if you project forward, I am going to go out on a limb and estimate that SY2024-25 is going to be around ~$188 million in expenses. Greater than in the 2022-23 year but less than last year’s spending - which looks like a crazy outlier now. It helps to have a competent CFO, I guess. So maybe things are trending in the right direction and there’s some reason for optimism? 🤷

Drop your takes in the comments!

It’s really hard to understand how we got to this point. The board completely failed in their fiduciary responsibility over and over but moving forward with this project after it became abundantly clear it was not only risky, did nothing to improve future educational outcomes and cherry on top - added millions per year more to expenses that it can not pay for - this should be criminal.

I understand that the lease certificate funds can’t be used for another purpose, but they represent D65 borrowing capacity (ie debt) that could have been leveraged for another purpose by another means and in any case will have to be repaid with real dollars. It’s not like this is a gift that we can only use for one thing and it’s “use it or lose it”. They are positioning it that way to say that we are pot-committed to the new school.